You said yes to bringing something to brunch.Or maybe you’re hosting Easter morning.Or it’s Christmas, everyone’s still in pajamas, and somehow the kitchen is already buzzing with hungry people. You want something warm, sweet, and easy to share — but you’re not about to spend $40 at a bakery or wrestle with yeast dough at…

Category: Uncategorized

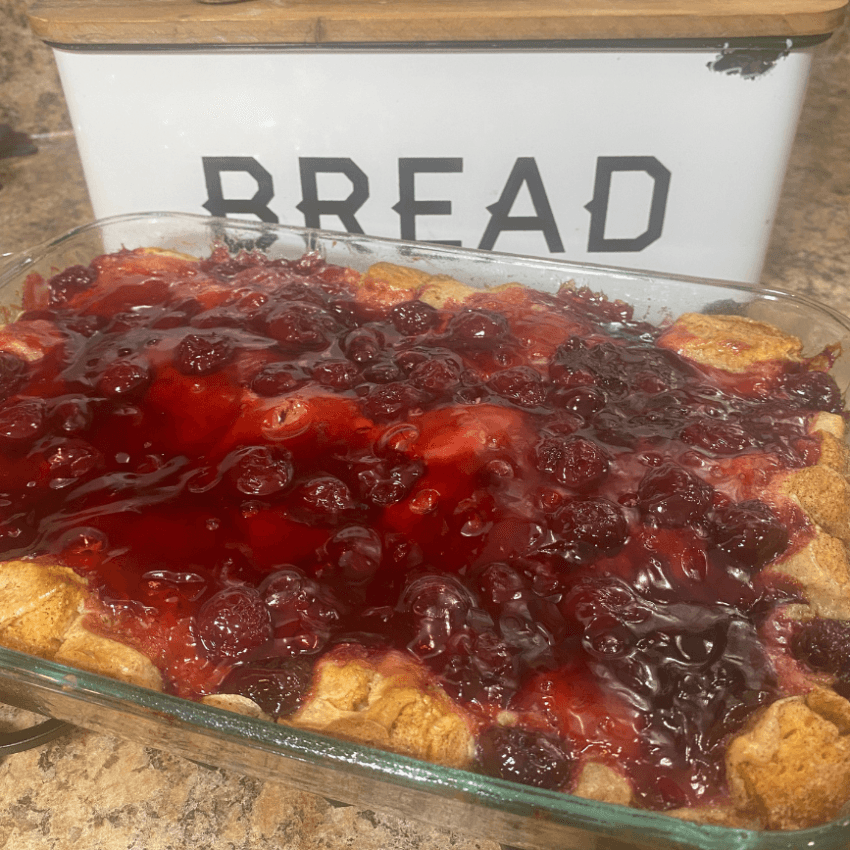

Family Dinner Ideas: Super Easy Casseroles for Busy Nights

Some nights I want dinner to feel like I tried… without actually trying. I don’t want a 14-step recipe.I don’t want three pans and a sink full of dishes.I just want something warm, filling, and guaranteed to be eaten. Casseroles check all the boxes. They’re forgiving. They stretch ingredients. They make leftovers feel intentional instead…

No-Bake St. Patrick’s Day Desserts on a Budget

St. Patrick’s Day has a way of sneaking up on you. One minute it’s just another week in March, and the next you’re signing up for classroom treats, planning a family dinner, or realizing you promised to bring dessert. Even a small holiday can add up quickly. That’s why I lean into no-bake desserts when…

20+ St. Patrick’s Day Dessert Buffet Ideas

Planning a St. Patrick’s Day dessert table usually starts with a simple thought like, “I’ll just make a couple of fun treats.” Then you start saving ideas, clicking links, and suddenly you’ve got more desserts than you need and no clear sense of what actually fits your time, budget, or theme. The goal here is…

Irish Party Food Recipes for Your St. Patrick’s Day Theme Party

Planning a St. Patrick’s Day party usually starts out simple. You picture a few people you like, something warm coming out of the oven, and a table that fills up naturally as everyone drifts in. Then you start thinking about the food — how much to make, what will actually get eaten, and whether you’ll…

14 Simple Chicken Casseroles for Easy Weeknight Dinners

When dinner needs to happen fast—but takeout isn’t in the budget—chicken casseroles are one of the easiest ways to get a hot, comforting meal on the table. They’re hearty, flexible, and easy to adapt to what you already have on hand. They’re the kind of meals that don’t ask for perfection—just a dish, whatever ingredients…

Cheap Tailgate Food and Simple Super Bowl Appetizers for a Crowd

Game day food always sounds simple until you’re balancing your schedule, your grocery list, and your budget all at once. You want enough food to keep everyone happy, without spending the whole weekend cooking or overspending on snacks that no one will eat. Focusing on cheap tailgate food that provide simple Super Bowl appetizers help…

20+ Pink Cocktail Ideas for a Galentine’s Day Party

Planning a Galentine’s Day party usually starts with good intentions and ends with a half-formed plan in your notes app. You want the night to feel special, but you don’t want it turning into a full-blown project. That’s where these pink cocktail ideas come in. They’re meant for the kind of get-together that fits into…

Valentine’s DIY Crafts on a Dollar Tree Budget

Every February it starts the same way. You run into the store for one thing and walk out with a buggy full of things you don’t need or you’ll never use. It adds up fast, and before you know it Valentine’s feels way more expensive than it ever should. This year I’m determined to change…

How To Plan a Galentine’s Day Party with Easy Mocktail Ideas

I don’t throw a Galentine’s Day party every year, but every February I start thinking about how nice it would be to do something simple — not in a “go buy twelve new things” way — more in the way that makes your kitchen smell like citrus, your counters cluttered with empty glasses, and your…